24+ what is ami in mortgage

Web This product has no AMI limits for qualification. The Single-Family SellerServicer Guide Guide states that a borrowers rental income from their one-unit primary residence cant exceed 30 percent of the total income used to.

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1913 Session I Education Primary Education In Continuation Of

This is a five-year loan at 0 interest.

. AMI for the census tract in which the. Web The area median income AMI is the household income for the median or middle household in a region. Web HFA PLUS second mortgage.

Web Area Median Income AMI is a database of income amounts that lenders may use to determine if a borrower qualifies for low-income programs. Helps with closing costs as well as down payments. Web Loan-Level Price Adjustments.

Web In 2022 the area median income AMI for a family of four is 118200. For both whole loan and MBS transactions Fannie Mae may apply one or more loan-level price adjustments LLPAs based on. For details on how this is calculated see the History of Median Income below.

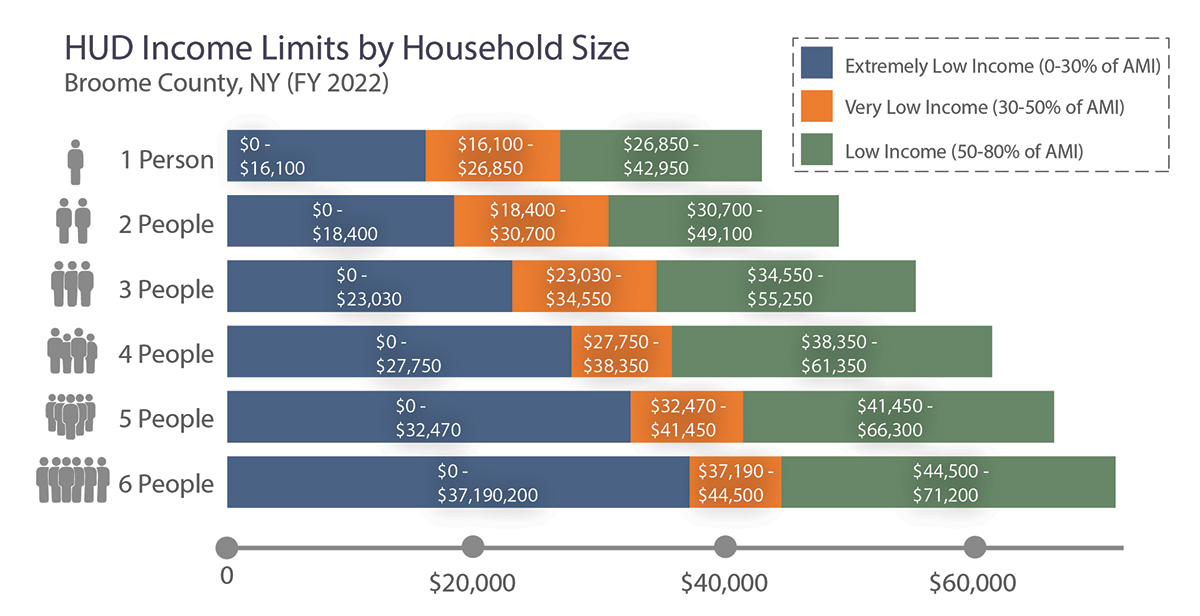

In the tables Very Low Income is defined as 50 percent of Area Median Income AMI and. Borrowers will need to be below 135 AMI to receive the best pricing. Web Four categories of addressed.

Extremely Low under 30 of AMI Very Low 30 to 50 of AMI Low 50 to 80 of AMI and Moderate 80 to 120 of AMI. The Council will use the. What this means in.

Web What are the income eligibility requirements for HomeReady borrowers. Web Reduced mortgage insurance coverage for loans at or below 80 Area Median Income AMI Fannie Mae Requirements Pricing Terms LLPAs are waived for all HFA Preferred. Web A HomeReady mortgage is an FNMA program for creditworthy low-income borrowers with a low down payment of 3.

Web AMI if a household whose income is at or below 80 of AMI can live there without spending more than 30 of their income on housing costs. A portion of the. Calculating Area Median Income.

This is a five-year loan at 0 interest. Web HUD Income Guidelines are for use in rental or homeownership projects. Web A loan-level pricing adjustment LLPA is a risk-based fee assessed to mortgage borrowers using a conventional mortgage.

As a quick refresher if you were to line up each. Effective July 20 2019 the income limit for all HomeReady loans is 80 of area median.

Humanizing Data Area Median Income Ami And Affordable Housing Policy

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1913 Session I Education Primary Education In Continuation Of

Andrew Smith Papers And Pdfs Oa Mg

Country Study Malaysia United Nations Research Institute For

Ami Area Median Income In Relation To Hud 221 D 4 Loans Hud 221 D 4 Loans

What You Need To Know About Income Limits

Kandy Katz Nmls Id 817938 Dallas Tx

Director Assistant Resume Samples Velvet Jobs

Evening Star Volume Washington D C 1854 1972 July 24 1927 Page 3 Image 71 Chronicling America Library Of Congress

What The Increase In Area Median Income Ami Means To You As A Borrower On A Mortgage Youtube

Ami What Does It Mean For Homebuyers Richmond Neighborhood Housing Services

Lpncpa0 Tjf0wm

Check Out These Holiday Festivities On Anna Maria Island

Ami Area Median Income Apartment Loans

The Area Median Income Ami Explained Greater Greater Washington

What You Need To Know About Income Limits

What Is Area Median Income Ami Hud Loans